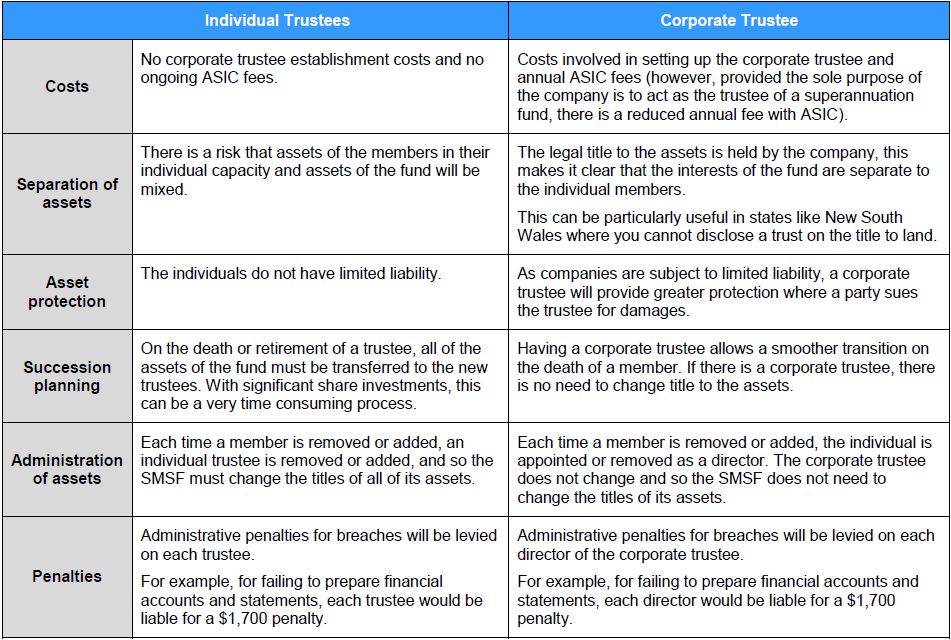

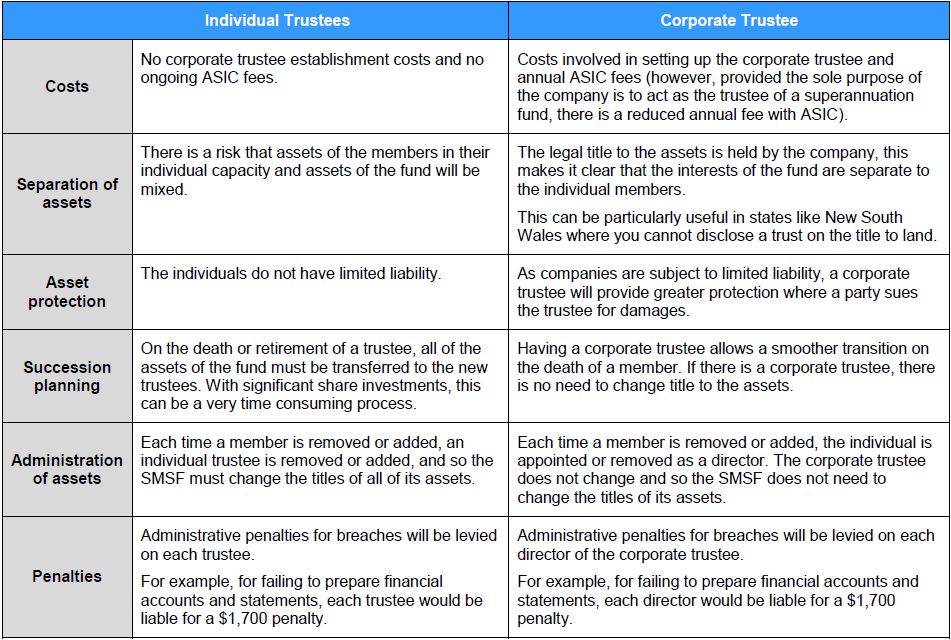

There are many issues to consider when determining whether to set up an SMSF with individuals or a corporate trustee. We generally recommend corporate trustees.

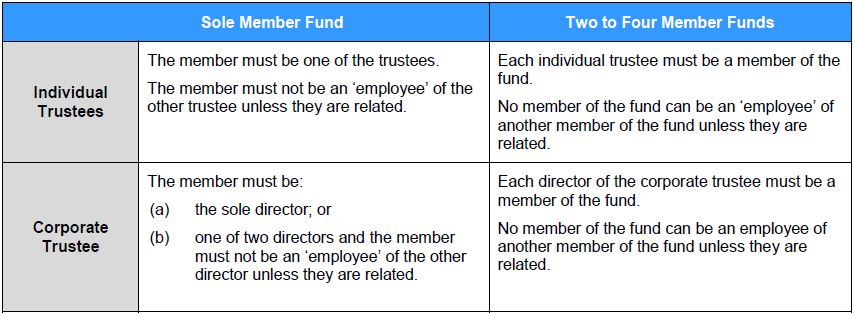

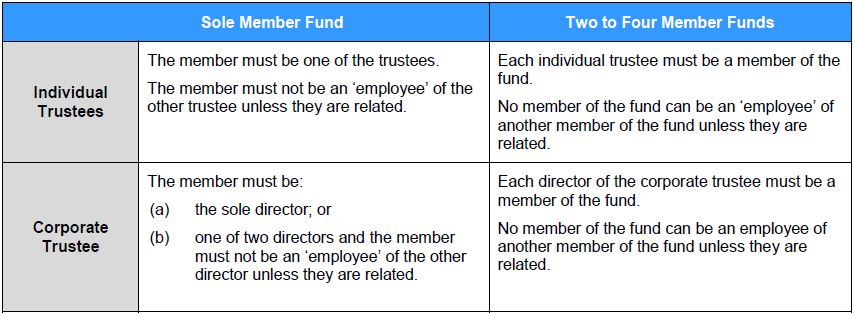

Under the Superannuation Industry (Supervision) Act 1993 (Cth), there are restrictions on who can be the trustees of SMSFs.

There are exceptions to these rules that apply in limited situations (such as when members lose capacity, when a member dies or when members are under 18 years old).

The requirements in relation to stamping a deed establishing a SMSF vary from state to state. As at June 2015, the only jurisdictions in Australia that require stamping are Tasmania ($50 nominal duty) and the Northern Territory ($20 nominal duty plus $5 for each copy of the SMSF trust deed). None of the other jurisdictions require new SMSF trust deeds to be stamped.